capital gains tax changes 2021 canada

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. 2021 federal capital gains tax rates.

We Finally Provide You With The Latest Version Of Cash App Hack Cash Cheat Generator This Hack Works For Ios Easy Money Online Money Apps Money Making Hacks

For tax purposes the gain would only be half of 35.

. If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. Generally capital gains are taxed on half of the gain. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35.

Gains inclusion rate may occur in the upcoming federal budget. Higher capital gains taxes may be in Canadas future. The House of Commons Standing Committee on Finance recommended in its February 2021 report according to an article in Advisors Edge published the same month that the capital gains tax on donations of private company shares and real property to registered charities be eliminated.

Increasing the capital gain inclusion rate may be one tax change the Canadian government could consider in order to boost tax revenues. Capital Gains Tax Rate. This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the next federal budget.

The changes are in effect for 2021 for the 202o tax year. For incomes above this threshold the additional amount of 1679 is reduced until it. The maximum pensionable earnings is 64900 an increase of 3300 from the 61600 in 2021.

The basic exemption amount remains at. This has Canada speculating again if a hike to the capital. Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in Canada.

This new proposed minimum tax appears to limit the benefits of all credits except for the foreign tax credit and would be calculated as 15 of taxable income for individuals in the top marginal tax bracket ie with taxable income in excess of 216511 for 2021. If your income was 445850 or more. If your income was between 0 and 40400.

The tables below show marginal tax rates. This means that different portions of your taxable income may be taxed at different rates. This means that.

The inclusion rate refers to how much of your capital gains will be taxed by the CRA. You can bypass the capital gains tax by taking full advantage of your TFSA and RRSP. From 12719 to 14398 for taxpayers with net income line 23600 of 155625 or less.

Possible Changes Coming to Tax on Capital Gains in Canada. 2021 430 pm EDT. Capital Gains Tax Rate 2021.

They have increased the Lifetime Capital Gains Exemption Limit LCGE For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. This recommendation was not implemented in the April 19 2021 budget.

For now the inclusion rate is 50. When this minimum tax is greater than the net federal tax it replaces the net federal tax and for Quebec. On March 22 2021 the Finance Minister Chrystia Freeland finally announced the date of the federal budget the Budget to be April 19th 2021.

As of September 7 2021 the share price is 3397 a year-to-date gain of 4382. The Federal government website says the following about Capital Gains changes in 2021. Between 1984 and 1994 there was a 100000 lifetime capital gains exemption that applied broadly to most capital assets.

Prior to 1972 capital gains were not taxable in Canada. In Canada 50 of the value of any capital gains are taxable. The CPP contribution rate for workers increases to 545 in 2021 or a total of 1090 when combined with the employer rate.

Although the concept of capital gains tax is not new to Canadians there have been several. So if you have realized capital gains of 200 you will get to. Upcoming Federal Budget April 19th Planning For Possible Capital Gains Tax Increase.

For example a single. Tax base improving tax enforcement and levying new taxes. Election platform the NDP proposed to increase the capital gains inclusion rate.

If your income was between 40001 and 445850. To 75 from 50. 1 The personal amount is increased federally and for Yukon.

The 2393 billion company hails from Calgary and. Taxes on Capital Gains. The federal budget date has not yet been announced but if a change is.

The taxes in Canada are calculated based on two critical variables. There has been much anticipation and speculation regarding the upcoming Budget as the previous budget was. The capital gains inclusion rate is by no means a sacred cow and I suspect it is perpetually on the table as a way to increase tax revenue without having.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. The capital gains tax rate in Ontario for the highest income bracket is 2676. This means that only half of your capital gains will be taxed by the CRA.

In 2016 there.

How To Save 5000 In A Year A Simple 52 Week Money Saving Challenge 52 Week Money Saving Challenge Money Saving Strategies Money Saving Challenge

Savings Goal Money Saving Strategies Saving Money Chart Money Saving Plan

Pin By Alex Spencer On Disney 2021 Vacation Savings Plan Vacation Savings Money Saving Strategies

Wealthsimple Gift Cards The Gift That Keeps Getting Bigger Wealthsimple Gift Card Cards Gifts

How To Avoid Taxes With A Tfsa Video Tax Free Savings Investing Savings Account

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Accounting Slogans Accounting Slogan Accounting Firms

2021 It Job Market And Bls Data Analysis By Janco Marketing Jobs Communications Jobs Job Satisfaction

Fastest Growing Jobs In The United States Vivid Maps Jobs In North Carolina Job Social Science

10 Long Term Capital Gain Tax To Benefit P2p Lending Players Read Our Complete Article Published On Moneyc Peer To Peer Lending P2p Lending Capital Gains Tax

Save 6000 In 6 Months Build Ira Emergency Fund Saving Money Chart Money Saving Strategies Money Saving Plan

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Historical 401k Contribution Limits Up To 2018 Historical Contribution 401k

Fitnancials A Finance Blog Money Saving Strategies Saving Money Chart Saving Money Budget

Employers Are Baffled As U S Benefits End And Jobs Go Begging Marketing Jobs Job Application Job

How To Prepare Financially For A 6 12 Month Career Break Money Management Activities Fire Movement Career

How To Save 10000 In A Year And Some Tuppennys Fireplace Video Video 52 Week Money Saving Challenge Money Saving Challenge Money Saving Techniques

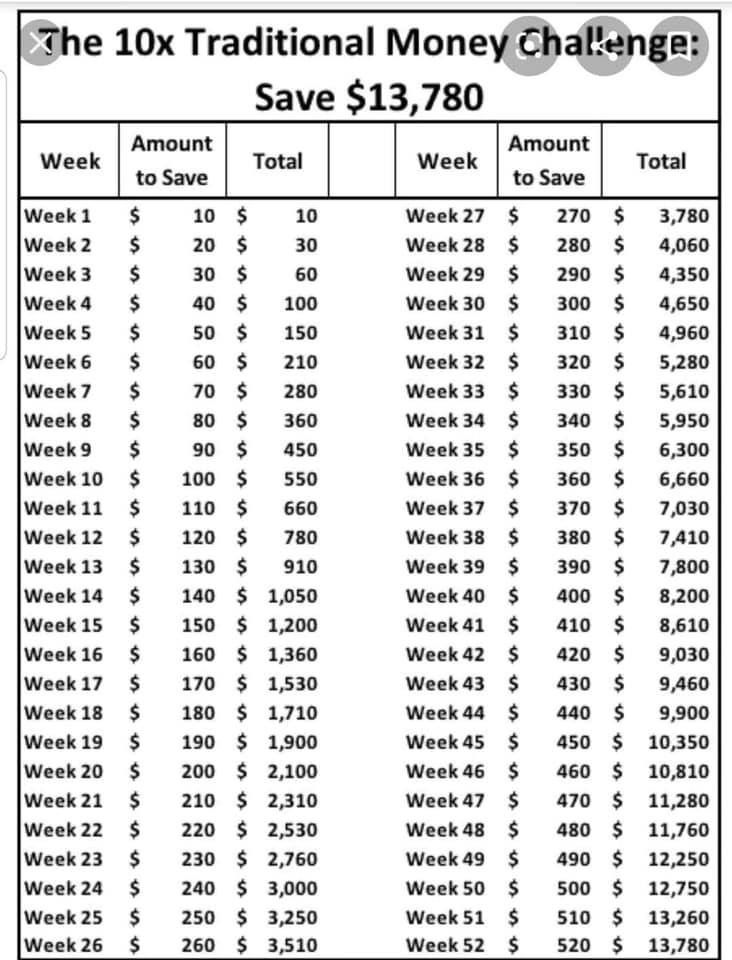

How To Save 10x Money Saving Methods Money Saving Strategies Saving Money Budget